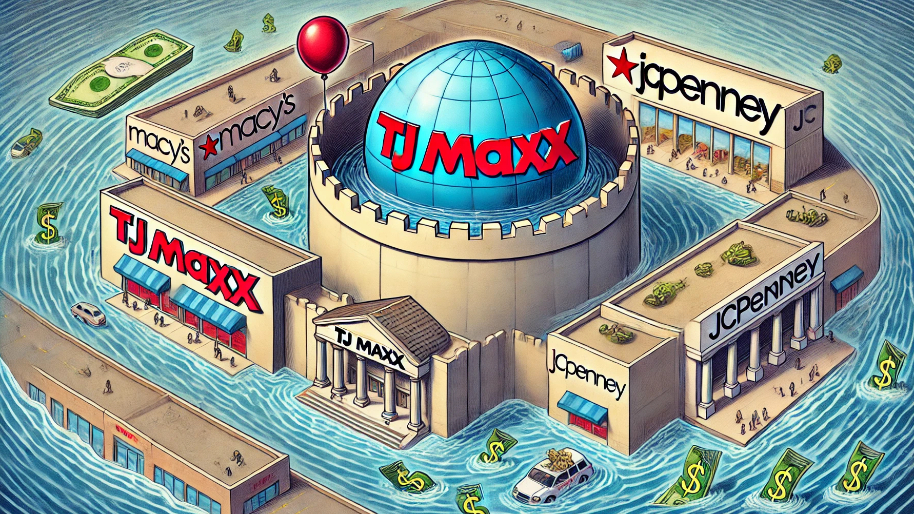

As Macy’s and JC Penney continue their slow-motion exit from relevance (and my living room fills with even more Amazon boxes courtesy of my wife’s shopping addiction), TJ Maxx is quietly carrying the entire retail community on its back.

Macy’s just reported a 7.2% drop in store traffic last quarter and plans to ax 125 stores—probably because no one needs another overpriced perfume sample (at this rate, they’ll be holding their Thanksgiving parade in a strip mall parking lot with balloons made from leftover Macy’s bags.) And JC Penney? Oh, bless their heart—they’ve been in hospice care since 2012, with over 800 stores probably turned into storage units. (I’m honestly surprised they haven’t started selling farewell merch: “JC Penney 1913–?”)

Cue the “hallelujah, hallelujah choir” because TJX, the parent company of TJ Maxx, Marshalls, and HomeGoods, is busy flipping the script. This quarter, they added 56 new stores and posted a 3% climb in comparable sales. This is a random side note but have you seen the checkout lines at TJ Maxx? (It reminds me of The Hunger Games, but for clearance candles).

Net sales jumped 6% year-over-year to a casual $12.5 billion. Diluted EPS came in at $1.14, giving Wall Street analysts something to smile about between sips of their $8 oat lattes. Oh, and their pre-tax profit margin climbed to 12.3%—probably why the stock’s up 27% this year. (Take notes, Macy’s. This is what winning looks like.)

CEO Ernie Herrman is leaning hard into TJX’s “treasure hunt” shopping model that has consumers coming in for the discount designer jeans and staying for the dopamine hit when you find a $300 throw pillow marked down to $19.99. Customer transactions are up, foot traffic is growing, and they even raised their full-year earnings guidance to $4.15–$4.17 per share.

Still, the analyst peanut gallery remains divided. Morningstar has TJX at a “hold,” likely because they think the stock’s already priced to perfection. Others, like Zacks, point to its steady performance and global growth ambitions as reasons to think about clicking that buy button.

So, is TJX a buy right now? Maybe not. But here’s the ultimate bullish case: middle-aged white women will never stop hunting for bargains at TJ Maxx. Ever. That’s not just customer loyalty; that’s a cultural phenomenon—and honestly, a moat Warren Buffett himself would respect.

PS: Tired of stock picks that flop harder than JC Penney’s “comeback” plans? At Stocks.News, we’re delivering gains that actually stack up (think 100%+ weekly on average). No gurus, no bs.

Check out our scoreboard and see why our members are crushing it while others are still window-shopping for wins.

Stock.News has positions in TJX and Amazon.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer