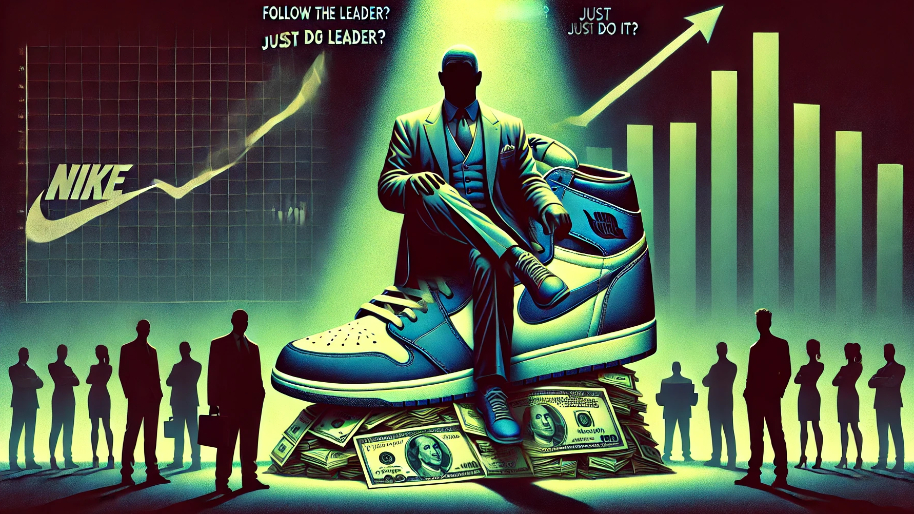

When it comes to finding opportunities in the stock market, Bill Ackman isn't your average hedge fund manager—he's basically the Sherlock Holmes of Wall Street. Armed with his magnifying glass (aka his sharp eye for underperforming companies), Ackman has decided that Nike is the next case he's cracking. And he’s backing up the brinks truck.

Recently, he increased his stake in the beaten down sportswear giant by a mind-boggling 436%. Talk about putting your money where your mouth is—or in this case, where your feet are. (Get it? Because... shoes? I’m sorry.)

It’s time to face reality. Nike, the company that taught us to "Just Do It," is currently in more of a "Just What Happened?" phase. Their stock has face-planted about 30% in 2024.

The company’s lifestyle segment is struggling significantly. Digital sales have dropped by 12% compared to the previous quarter, marking a concerning trend in consumer engagement. Even their Greater China operations have seen a 15% decline in revenue year-over-year, largely due to weaker demand and fierce competition from brands like Lululemon and On.

So, what's Ackman thinking? Here's where it gets interesting. While most Wall Street players treat their portfolios like an all-you-can-eat buffet, Ackman's more of a michelin-star chef with a tasting menu of just 11 companies. And he just added Nike as his main course, with a helping that would make even Joey Chestnut say “that's too much”. Ackman went for an 11% stake (worth $1.4 billion).

On top of that, Nike just got a new boss, and Elliott Hill, the freshly appointed CEO, is basically the Gandalf of sportswear… wise, experienced, and hopefully not yelling, “You shall not pass!” at the quarterly meetings. Seriously tho, the guy’s been with Nike longer than some of us have been alive.

So, should you jump on the Nike bandwagon? Look, following Bill Ackman into Nike right now is pretty risky—you know there's potential for great results, but the timing might seem a bit suspect to outsiders. Everyone knows Nike, everyone has an opinion about them, and they're probably wearing their products while complaining about them.

The company's got brand recognition that makes other brands look like startups, and a loyal customer base that keeps coming back for more. But those direct-to-consumer problems and digital sales are sticking around like my neighbors halloween decorations (come on guys, it’s Thanksgiving).

Nike’s problems won’t be a quick fix. Ackman's basically betting that Nike isn't just having a mid-life crisis but is instead going through an awkward phase that it'll grow out of with the right guidance (and about $1 billion of his money).

Personally, I think Ackman’s Nike gamble is as solid as any billionaire’s pet project (you know, minus the vanity space rockets). 2024 has been epically bad for Nike. The stock is currently in the middle of one of the worst annual flops in company history. (Congrats, 2024, you’ve outdone the chaos of 2020. Quite the achievement.) Even back when retail stores were closed, and people were hoarding sweatpants like toilet paper, Nike didn’t see this level of disrespect.

But here’s the thing… Nike’s stock is like that friend who always bounces back after a breakup. (You know the type: a week later, they’re dating someone hotter.) Give it 12 months, and I wouldn’t be surprised if the panic sellers are kicking themselves for this one. And hey, if I’m wrong? Let’s just pretend this little rant never happened. Deal?

PS: It’s not 2020 anymore. Stop handing over $2,000 to "fake gurus" who promise the moon and deliver belly flops. If you’re ready for real trading ideas that actually pay off, switch to Stocks.News. We’re not perfect, but since we started, our members have seen at least one 100%+ alert every single week on average (and yeah, sometimes more). Click here to see the details now.

Stock.News has positions in Nike, Lululemon, and On.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer