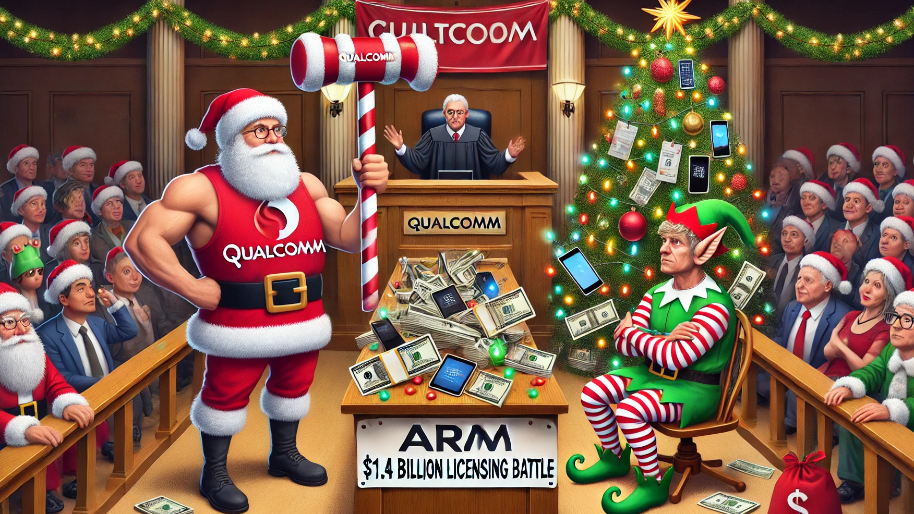

While you were busy putting cookies and milk out for Santa (or eating them yourself at midnight), Qualcomm was confidently strutting out of a Delaware courtroom like Tom Cruise when he won an Oscar. After months of courtroom bickering, a jury decided Qualcomm hadn’t breached Arm’s licensing agreement after its $1.4 billion acquisition of Nuvia in 2021. In English: Qualcomm gets to keep using Arm’s chip architecture to build its new Oryon CPUs. As for Arm? Well, it’s coping in the corner and gearing up for round two. But let’s roll the tape back a bit. Why were these two tech companies in a courtroom slap fight to begin with?

Arm accused Qualcomm of doing some sneaky business, claiming that after Qualcomm scooped up Nuvia, they should’ve ponied up more cash to license Nuvia’s designs. Qualcomm essentially said, “This is ridiculous, we should all be at home drinking eggnog” arguing that their existing deal covered it all. And guess what? The jury mostly agreed. They ruled that Qualcomm didn’t breach Arm’s license. But things got messy when it came to whether Nuvia (before Qualcomm swooped in) had violated its own licensing terms. The jury couldn’t agree, so the judge called a mistrial. Judge Maryellen Noreika summed it up with a diplomatic, “Neither side had a clear victory” (everyone wasted a ton of time and money).

Qualcomm’s CEO, Cristiano Amon, wasn’t coy about playing the blame game. He told jurors that Arm’s lawsuit caused unnecessary chaos, spooking major customers like Samsung into thinking they might lose access to Qualcomm chips. Amon also hinted that Arm’s demands were, let’s say, overly ambitious (or just plain greedy). Despite the court drama, the ruling is a big W for Qualcomm. It clears the way for the company to keep developing its Oryon CPUs, which analysts like JP Morgan’s Samik Chatterjee say is a huge relief for investors that have their cursor over the sell button. Qualcomm’s stock jumped 3.5% to $158.24 after the verdict.

Of course on the other side of the table, Arm is gearing up for the sequel nobody asked for. They’re seeking a retrial to “protect their intellectual property” (or, you know, their ego). Arm’s also under pressure to jack up royalties across the board, a move that’s making the semiconductor industry pretty skeptical to say the least. (Seriously, how do you demand more money from the people keeping your business running?) This whole story is like a bad breakup that everyone saw coming. Qualcomm wants to innovate and expand into AI and PCs, while Arm is trying to have its cake and eat it too… playing both supplier and competitor.

For now, Qualcomm gets to keep tinkering with its Nuvia toys while Arm sulks in the corner, wondering if suing its largest customer was the galaxy-brain move they thought it was (it wasn’t).

PS: Want the ultimate Christmas gift? How about the power to spy on insider trades of any publicly listed company? That way, you can stop being the sucker left holding the bag when the insiders cash out. All it takes is a Stocks.News Premium membership (seriously, it’s cheaper than HBO Max). Go here and start legally piggybacking the insider’s trades.

Oh, and Merry Christmas ya filthy animal!

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer