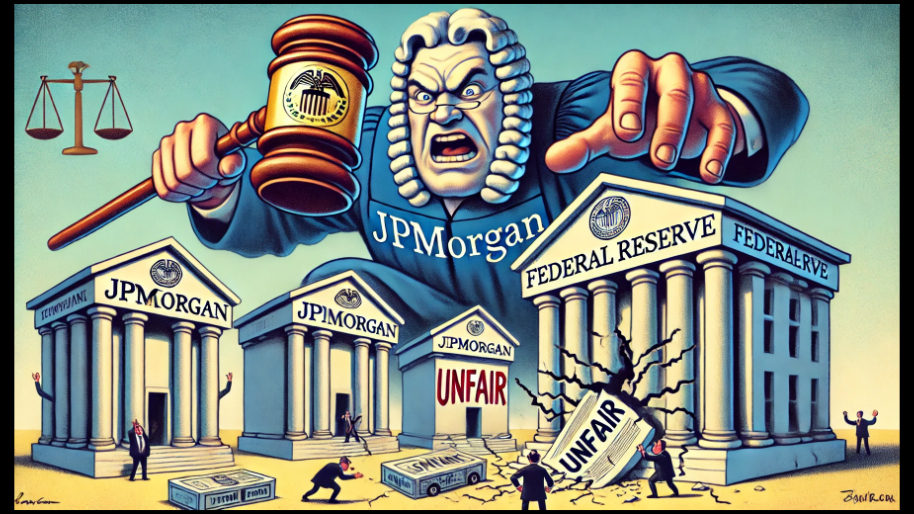

Have you ever sued your parents for forcing you to do your homework? I haven’t, but here we are, where JPMorgan, Citigroup, Goldman Sachs, and a crew of trade groups (shoutout to the Bank Policy Institute and the U.S. Chamber of Commerce) are giving us a full-on clinic on how to do so. In short, America’s biggest banks are suing the Federal Reserve for their infamous annual stress tests—a.k.a. the financial equivalent of a surprise pop quiz you know your teacher makes harder just to prove a point.

(Source: Giphy)

The lawsuit, filed in Ohio, claims the Fed’s current stress test process is about as transparent as the recipe for the Krusty Krab. Banks are accusing the Fed of using vague, unexplained methods that lead to wildly unpredictable capital requirements—requirements that can cost individual banks billions and allegedly stifle the broader economy. In other words, the banks are tired of playing a game where the rules change every year, and they’re calling foul.

(Source: CNBC)

Now for those of you who don’t know what a “stress test” is, basically these are designed to see how banks would hold up in a financial apocalypse (think 2008, but scarier). They dictate how much capital banks have to keep on hand to cover potential losses. Fail the test, and regulators could force you to hold more capital, which means less cash for share buybacks, dividends, and, you know, making loans.

Now to be clear, the banks aren’t saying they want to ditch stress testing altogether—because let’s face it, that PR strategy would be dead on arrival. Instead, they’re arguing that the Fed’s process is unnecessarily opaque, volatile, and, frankly, outdated. According to the lawsuit, the Fed has been keeping its supervisory models and stress scenarios under wraps, which makes it hard for banks to prepare. Imagine your boss telling you there’s a “really important” meeting tomorrow but refusing to share the agenda. That’s the vibe here.

(Source: Giphy)

But, but, but, the timing here is… well, interesting. This lawsuit comes just one day after the Fed announced plans to maybe overhaul the stress test process. The central bank said it’s considering changes to make the tests more transparent and consistent, including allowing public comment on their hypothetical scenarios and models. Sounds like progress, right? Not so fast.

Simply put, the banks aren’t buying it, calling the announcement “too little, too late.” Meaning, with a statute of limitations on the current stress test rules expiring in February, the lawsuit feels like one of a preemptive strike. However, this isn’t necessarily spontaneous on the bank's part. Big bank CEOs like Jamie Dimon (JPMorgan) and Brian Moynihan (Bank of America) have been railing against these tests for years, claiming they’re overly punitive and push financial activity into less-regulated (read: sketchier) markets. They argue that the current system prioritizes optics over actual risk management, creating new systemic risks instead of preventing them.

(Source: Wall Street Journal)

On the other side, groups like Better Markets—a left-leaning economics think tank—are warning that any changes could let Wall Street game the system. According to their president, Dennis Kelleher, the Fed’s proposed reforms might make stress tests “predictable, highly gameable, and very favorable” to the banks. Translation: Critics think the banks are trying to turn a pop quiz into an open-book test.

In the end, while there’s quite a bit of anti-peasant slang being thrown around in this lawsuit, let’s just call it what it is shall we? This is a friggin’ power struggle wrapped in a lawsuit. The banks want more control over the rules of the game, while the Fed wants to keep its reputation as the tough-but-fair referee of the financial system. Both sides are playing for high stakes. For the banks, billions in capital hang in the balance. For the Fed, it’s about maintaining credibility in an era where trust in institutions is shakier than a Jenga tower in the final round.

(Source: Giphy)

If you’re wondering why this matters to you, consider this: The outcome of this battle could shape how banks operate (read: how much they can lend, invest, or reward shareholders) for years to come. It might even impact the broader economy, because when banks sneeze, the rest of us tend to catch a cold.

This all has Wall Street holding its breath in the meantime. Will the banks get their way, or will the Fed hold the line? Either way, America’s most notorious shady bankers have made it clear they’re willing to fight this out in court, especially if they think the Feds reforms won’t go far enough.

(Source: Giphy)

In the meantime, keep your eyes on how this whole thing unfolds in the coming days, but for those betting on who wins this cage match, just remember: The Fed controls the interest rates, but the banks control the lawyers. Choose wisely. As always, stay safe and stay frosty, friends! Until next time…

P.S. ICYMI, The Pentagon just handed Lockheed Martin an $11 Billion blank check to build its newest F-35 fighter jet fleet—and you bet your a$$ our Congressional Trade Tool spotted some mischievous politicians loading up on Lockheed BEFORE this became official. Meaning, if you’re looking to see where our most fraudulent loyal civil servants are placing their bets to catapult their net worths… Simply click here to try our proprietary Congressional Trade tool with Stocks.News premium today!

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer