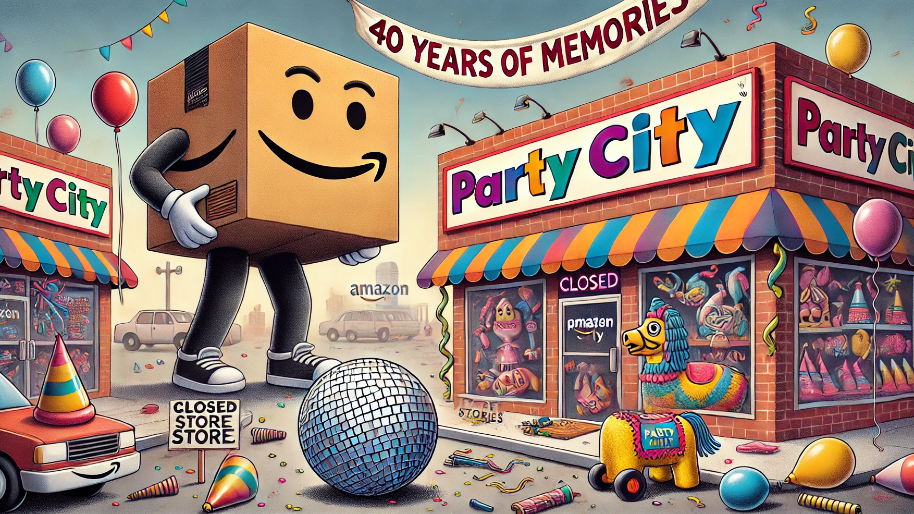

Well, folks, that’s a wrap. After almost 40 years of hawking balloons, glitter, and wigs you’d only wear in public on Halloween, Party City is throwing in the towel and officially shutting down all 800 of its stores.

The announcement hit employees pretty hard (to say the least). No severance. No benefits. Just a Zoom call with CEO Barry Litwin delivering the corporate equivalent of, “It’s not you, it’s us… actually, it’s definitely us.”

The news dropped on Friday, with Litwin telling employees their jobs were gone effective immediately. No fond farewell, no consolation balloons… just a quick “best of luck,” followed by the sound of helium tanks being wheeled away.

So, why did the Party End? Let’s not kid ourselves… the Grim Reaper of retail is Amazon. Once again, Bezos’ empire proved it could crush anything that requires a brick-and-mortar location. Why drag yourself to Party City for overpriced napkins when Amazon can airdrop them to your doorstep in just a few hours? Pair that with budget behemoths like Walmart, Costco, and Target swooping in to undercut prices, and Party City didn’t stand a chance (we all knew this, but were secretly hoping Party City would be the one outlier).

But wait, the disaster gets messier. Party City wasn’t just duking it out with competitors… it was also drowning under a crushing $800 million mountain of debt. And unlike our dear government, they were actually trying to pay it off (gold star for effort, I guess).

After declaring bankruptcy in January 2023, they managed to wipe $1 billion off their books and boldly promised a comeback. That comeback fizzled faster than the sparklers I grabbed at Dollar Tree last Fourth of July (cue the “back it up Terry” meme because why not?).

Inflation didn’t help, either. Rising costs squeezed Party City’s razor-thin profit margins until they flatlined. And let’s not forget the helium shortage (yes this is real) the cruel twist of fate that crippled their balloon biz, their bread-and-butter revenue stream. No helium, no balloons. No balloons, no party.

The final weeks at Party City HQ were… messy. Employees were sent home December 10th to find the corporate doors locked and security guards warning about “tailgaters” (as if desperate ex-staff were going to storm the gates). Oh and product development teams were yanked off vendor trips with a “sorry, we can’t pay the bill” email.

By the time Litwin gathered everyone on a call last Friday, the jig was up. Corporate employees vented their rage in Microsoft Teams chats, with many blindsided since management had been exuding some seriously Oscar-worthy optimism at recent meetings. HR Chief Karen McGowan broke down in tears during the call, explaining there’d be no severance or extended benefits. “Sorry, we’re broke” doesn’t really soften the blow.

As Party City shuts its doors, it’s clear that the party supply giant just couldn’t keep up. Maybe it was the crushing debt, the Amazon-shaped competition, or the general retail apocalypse we’ve been watching unfold since 2010.

PS: On Friday, our Stocks.News Premium members hit the jackpot with a Toronto biotech stock nobody cared about Wednesday. Our system flagged it for absurdly high short interest—basically, Wall Street’s equivalent of leaving the back door wide open—and then, boom, they casually announced a licensing deal with a major pharma company. By lunchtime, the stock shot from $2 to $6.80, handing out 240% gains (not bad right?).

If you’re tired of missing out on plays like this, maybe it’s time to join Stocks.News Premium. You’ll get trade alerts like this twice a week, plus our Insider Trading Tool that tracks everyone from overpaid CEOs to your favorite Congress members cashing in on their "foresight." Oh, and unlike Bloomberg, we don’t charge a small fortune for the privilege. They might have fancy terminals, but do they deliver breaking trade alerts and tools that actually move the needle? Didn’t think so. Go here to become a Stocks.News premium member now.

Stock.News has positions in Costco, Target, Dollar Tree, Zoom, Microsoft, Amazon, and Walmart mentioned in article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer